Tax Law

Tax law is constantly evolving, shaped by continuous amendments and shifting interpretations. Whether you're advising on corporate tax liability, handling VAT-disputes, or building a case around past obligations, research precision is critical.

Use cases

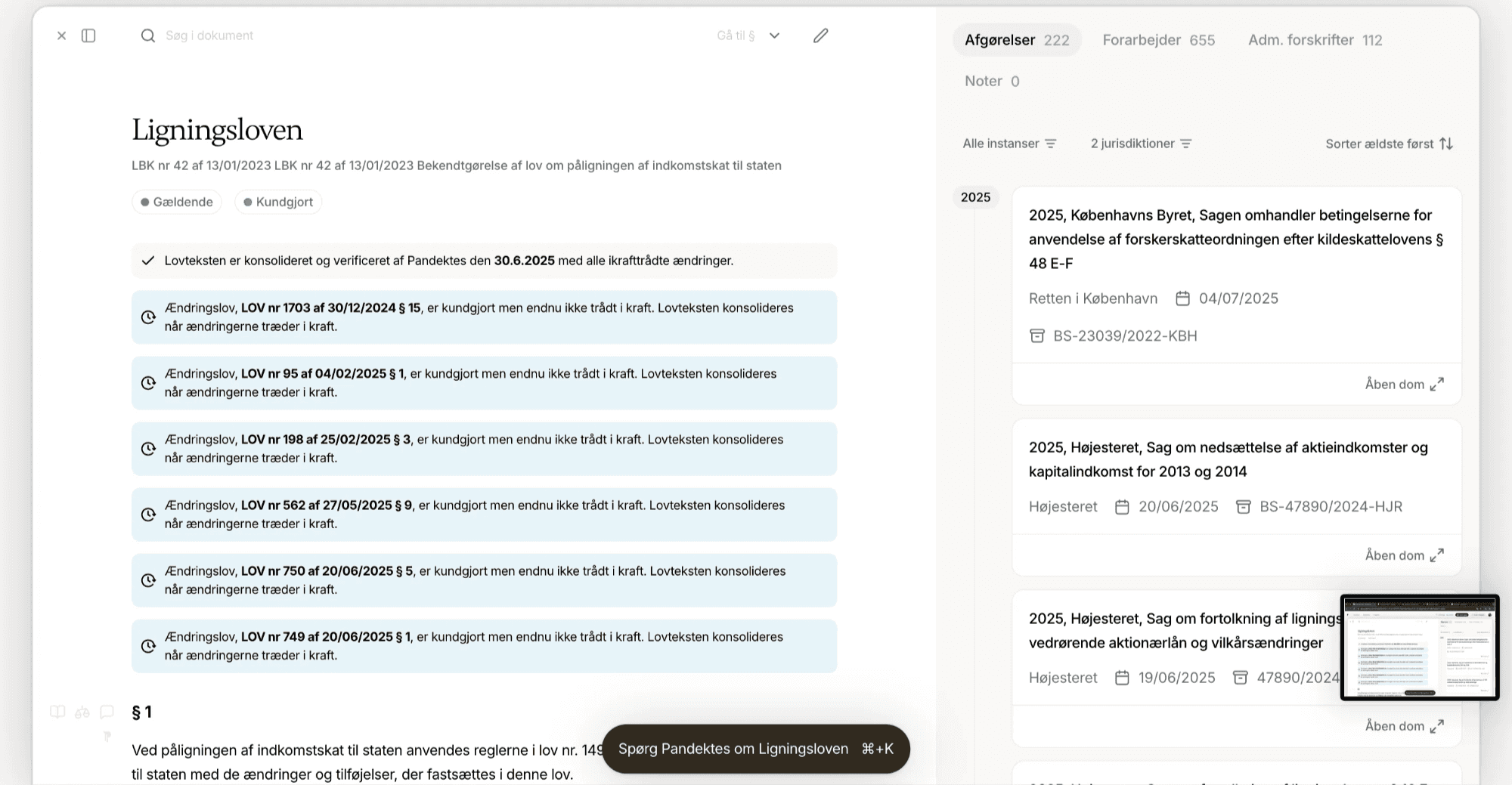

Historic insights to understand laws in-depth

Pandektes gives you access to historical versions of laws and guidance, helping you understand what applied at the relevant time and how changes have evolved over time. You can compare amendments, interpret transitions, and build stronger retrospective analyses with confidence.

Build smarter and stronger tax cases

Group together historic rulings, process notes, annexes, and financial documents in Pandektes Projects. Search across all materials with AI-powered insight to spot patterns, test arguments, and surface critical numbers. Collaborate with your team in a shared Project that ensures full alignment, complete oversight, and no missed details.

Stay ahead on changes for tax law

Pandektes helps you track new amendments before they take effect and analyse their likely impact on your clients. Understand not just what is changing, but how it alters compliance obligations and legal strategy. This way you’re always one step ahead.